International students coming to the U.S. to pursue their higher education carry great expectations along with them which is both an opportunity, but requires that you pay close attention to finances. You can't avoid managing an academic budget if you want to succeed, especially as an undergraduate, although it's often a secondary concern. Tuition costs in themselves would add up to $35,000 - $50,000 each year and location based living expenses can be an absolute burden.

Estimating Living Costs with a Budget

Regional Accommodation Costs (Monthly Statistical Figures)

Accommodations of Higher Cost Regions:

- Sharing apartments in New York City: $1,200-2,500

- Sharing housing in San Francisco: $1,100-2,200

- Los Angeles shared accommodations: $900-1,800

- Boston shared rooms: $800-1,600

Accommodations of Moderate Cost Regions:

- Chicago: $600-1,200

- Philadelphia: $550-1,100

- Austin: $500-1,000

- Seattle: $700-1,300

Accommodations of Lower Cost Regions:

- Atlanta: $400-800

- Phoenix: $450-850

- Indianapolis: $350-650

- Raleigh-Durham: $400-750

Students who do not reside in the area spend approximately $250-400 on groceries each month if they self-cater. Hot drink and fast food meal breaks cost $12-18, while dinner meals are priced at $20-35.

Transportation Costs:

- Public transport monthly pass: $50-$150

- Owning a car (all expenses): $300-$500 per month

- Campus shuttles often free

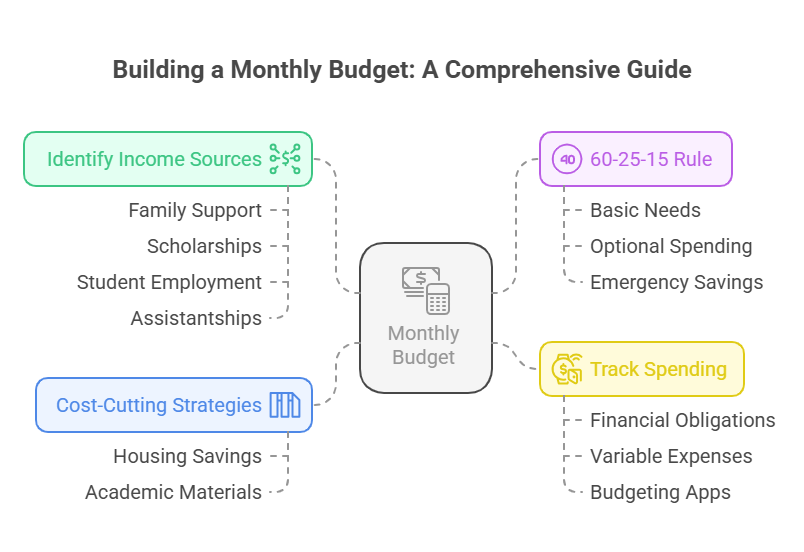

A Guide to Building Your Monthly Budget

Step 1: Identify All Funds Available

Identify all sources of income:

- Family support

- Amounts received from scholarships

- Student employment (F1 students: 20 hours/week max)

- Teaching or research assistantships

Illustration:

- Family support: $1550/month

- On-campus job: $600/month (20 hours x $15/hour)

- Total Income per month: $2100

Step 2: Implement the 60-25-15 Rule

Basic Needs (60%):

- Allocate 35-40% of income towards housing

- Allocate 15-20% of income towards food

- Allocate 5-10% of income towards transportation

Optional Spending (25%):

- Social and recreational activities

- Self-care and beauty products

Emergency Savings (15%):

- Hold 3-6 months worth of expenses.

- Renew visa and prepare for other unplanned expenses

Step 3: Track Spending

Recommended apps:

- Mint (free all-in-one app)

- YNAB (students get a discount)

- PocketGuard (helps in stopping overspending)

Compile a list of financial obligations such as rent and insurance, along with variable expenses like entertainment and food.

Step 4: Implement Cost-Cutting Strategies

Savings from housing:

- A 40-60% reduction in expenses can be achieved by sharing an apartment.

- Don't forget to check if the college has its own housing facilities (which may include utilities).

- Economic reasons make distance from Campus more appealing.

Prices for academic materials:

- Old textbooks can be purchased or rented through Chegg.

- Make use of the university library's available resources.

- Join or create study groups to share some of the financial burden.

Advanced Money Management

Early Credit Building

Secured Credit Cards

- Capital One Secured (no overseas fees).

- Discover it Secured (offers cashback).

- Start with a $200 to $500 deposit.

Steps:

- Make a few small purchases on the card I plan to fill (less than 30% of limit).

- Pay the entire balance each month.

- Check credit score via Credit Karma.

- After 6-12 months of usage, you can qualify for unsecured cards.

Smart Banking

These options for students:

- Chase College Checking (with no monthly payment).

- Bank of America Student Checking.

- Local credit unions (better deals).

Earning money

On campus for:

- Research assistant: $12 - $20/ hour.

- Teaching assistant: $15-$25/ hour.

- Campus positions: $8 - $15/ hour.

- Residence advisor: free housing plus stipend.

Regional differences

Comparison of costs

East Coast:

- Opportunities are more abundant, albeit at a higher cost.

- Exceptional public transport

- Good international communities

West Coast:

- Access to technology industry

- Temperate climates

- Asian markets accessible

Midwest:

- Estimate 30 - 50% lower costs of living

- Friendly society

- Lack of competition for accommodation.

Whereas large cities provide:

- Access to numerous career openings.

- Various dishes and restaurants.

- Useful transportation services.

- Entertainment and social events.

Unplanned Financial Strategies

Creating A Budget Cancelling Paying Off Debt

Fundamentals

- $2,000 - $5,000 set aside for emergencies.

- Savings of 3 - 6 months living expenses.

- Savings account with high interest rates.

Prevalent emergency situations:

- Medical costs.

- Change in family finances.

- Hold on visa applications.

- Change of laptops and phones.

Crisis Resource Centre

College aid:

- Emergency financial aid services.

- Provision of meals services.

- Counseling services.

- Academic advisory services.

Aid from other sources:

- Local charitable organizations.

- Faith-based organizations.

- Non-profit organizations that offer assistance to students.

Seasonal Allocation Of Funds

Additional Considerations During Summer

If remaining in the US:

- Change in accommodation prices.

- Possible loss of employment.

- Increased cost or utilization of social and recreational activities.

When traveling home:

- Costs of flights: $800 - $2,500.

- Spending on renewing visa.

- Costs related to setup when coming back.

Conclusion

As an international student in the USA, it may seem as if balancing academic life and personal finances is a colossal challenge. However, with effective scheduling and smart budgeting, you can maintain peak academic performance without being financially drained. By developing a practical budget, making use of student discounts, as well as campus resources, you will have financial literacy skills that will be of value throughout your life.

Do not forget that saved money, even in small quantities is still essential, especially when savings become a habit and will follow you for the rest of your life. Education is one of the many ways individuals invest in their future. With appropriate strategy planning, it is possible to have an increased opportunity while preserving better financial health.

FAQS

What is the best budgeting for an international student to have on a monthly basis?

Ranges from $1200-$2500 depending on location, subsidized housing takes up 35-50% of the expenses.

If you reside in expensive areas such as New York or San Francisco, anticipate costs to be around $2,000-$2,500/month. However, more affordable college towns will set you back around $1,200-$1,800.

Can an individual work while studying on an F-1 visa?

Sure, F-1 permits students to work part-time (less than 20 hours) on-campus while attending classes and full-time during breaks. Other types of work sessions off-campus need special permission via CPT or OPT. Usually pays between $8-$20, depending on the type of work and the university.

What do international students underestimate the most when planning a budget?

Likely their income, coupled with high estimations for housing, seasonal spending, and other expenses. It's common for students to budget for 9-month academic years, forgetting summer expenses and/or income drop during breaks. You should always aim for a year's worth of planning in terms of budget and set aside funds for emergencies.

How can an international student begin developing a credit score?

The first step would be getting a secured credit card because it is easier to get than an unsecured one. These cards require a deposit of $200−$500 which can serve as credit for small transactions. If a person stays within the 30% usage mark and pays off their balance, they can transition to better unsecured cards after a duration of 6-12 months.

Is public transport or owning a car more suitable for me?

That completely depends on where you are located in the university. In places such as New York, San Francisco, or Boston, spending money on a car is futile because public transport is so effective and accessible. College towns are smaller and more dependent on cars, making car ownership more practical. If you do decide to buy a car, budget $300−$500 a month for its maintenance.

What steps do I take to control the impacts of currency changes on my budget?

You should prepare for changes in exchange rates. Plan your big transfers for periods when rates are at their most favorable. Two accounts, one with the local currency and another in USD, may work best for you. A Wise account also helps with the removal of heavy bank fees as a through service like Wise (previously TransferWise). Always put aside 10-15% of your budgeted amount to stay within limits.

What kind of assistance can I get if I'm experiencing a financial problem?

You may turn to your university's international student services as your first contact. Many universities provide students with emergency funds as well as some form of a food bank and financial aid services; make certain to utilize the guidance offered. Try contacting some other ethnic or community non-profit organizations that focus on helping immigrants. On a personal level, discuss the matter with your family while including academic advisors regarding potential changes around course load or other shifts.